Check my retirement plan

My wife and I were looking over our finances and prospects for the next decade or so as we approach retirement. We've been incredibly lucky to have kept our jobs during the pandemic and are happily in a place where we don't have to worry as much about the day-to-day as we did when we were younger, and can invest for our future.

Here's what I'm thinking - does this make sense, or am I missing something?

- Max out retirement plans through employers

- Refinance mortgage while market rates are low

- Invest in Index Funds with no management fees

- Have six months expenses worth of cash in the bank to mitigate any unforseen emergencies

- Don't allow living expenses to balloon to meet increased income.

That seems pretty solid to me, but I've had blind spots before. Any thoughts?

Answers ( 2 )

So the good news is that you're doing a lot of things right -- the things you list are all good ideas, in my opinion, with one possible quibble.

Maxing out a 401(k),403(b), or 457 plan is almost always a great idea, and if your employer will match part or all of your contributions, then it's REALLY difficult to make up a scenario where it's not the best idea you can come up with for retirement savings.

Refinancing your mortgage is just a math computation -- if you have to pay money up front to start the new mortgage, then you can compute your break-even point (ie, when you save more from the new mortgage compared to the old than you spent up front). Be sure to realize two things that might not be pointed out to you by a mortgage broker, though -- if you have a new 30 year mortgage, then you've re-started the clock on your schedule to pay off your home. Also, because of inflation, money spent today is worth more than money saved in the future. But if you re-fi and just keep making the same payments as before (with the difference being applied to principle), then it can be a big win.

Index funds with low/no management fees are just a big winner in my mind. If you took your birthyear, added 60, and picked the Vanguard Target Retirement Index Fund with the year closest to that, you would be probably about 95% perfectly invested, for something like 15 cents per $100 invested per year.

The six months expenses in the bank is my quibble, though. I think you should be able to access some reasonable amount of money, but there's no reason that money couldn't be invested. There's a risk of loss, sure, but there's also a risk of missing out on gains. If you hold $50k in savings, you're missing out on $3000 or $4000 a year in expected gains. That's a REALLY expensive insurance policy. If you have a credit card, you can get past almost any immediate crisis and if you have that money invested in regular taxable accounts (that is, not in IRAs or 401(k)s), then you'd sell some in an emergency to pay off the credit card. But just letting the money sit idle is just too passive, in my opinion.

Don't let living expenses balloon? Absolutely. "Buying shit doesn't make you happy." This is the exact opposite of what is hammered into every American's head for decades on end. But it's true.

If you have any specific questions with details about your situation you'd prefer to discuss privately, please consider a private Sage question.

Finally, here's a more general answer I've given many times on other web sites. Not all of it will apply to your specific situation, but you might find something here that's useful to you.

Whether you’re saving for retirement or seeking wealth through the magic of compound growth, the “secret” is really just a simple three-step plan:

1. Earn a decent living and live beneath your means

2. Invest that difference automatically, and increase the investment with each raise

3. Invest in a way that takes advantage of your tax situation and choose ultra-low-cost (0.20% per year or less), passively managed, widely diversified (across stocks and bonds and across domestic and international) index funds that are appropriately balanced for your age.

The first thing you want to realize is that you do not need to find a way to spend every last cent you earn. :-) No matter what you earn or where you live, there is someone living near you who earns less and still leads a happy life. Live like that person. The rest of this answer will give you ideas about how to take advantage of the difference between what you make and what you spend so that you can invest for retirement, where you can reach the point where you can do whatever work you do because you *want* to, not because you *have* to. That kind of freedom is a very nice feeling!

In America, you'll want to use legal ways to avoid taxes where you can. Your employer probably has a web site describing your options: a 401(k) plan -- especially if it includes a match from your employer, where they contribute if you do -- is usually at the top of the list. Other things include a 403(b) (if you're at a non-profit), 457 (if you work for some states), and 529 (if you want to save for your children's future expenses). You can also fund your own Traditional IRA if you want, directly through a brokerage like Vanguard or Fidelity. You can't do *all* of them, though; the IRS determines which combinations you can do.

All of these are tax-deferred, meaning that the money you invest won't be taxed now (and that lowers your tax at your marginal rate, which is probably at least 25% plus whatever your state income tax is). It puts the money away until you're 59.5 or thereabouts and then you finally pay income tax when you take it out (but if you've stopped working by then, it'll almost certainly be at a lower rate because it'll be your total tax rate, not just the higher marginal rate).

There are limits to how much money you can put into these, though, and if you're disciplined about investing, you're probably going to hit them. :-) That's okay, you have more options: the Roth IRA is like a 401(k), but you pay taxes now, but never have to pay taxes on any of the profits, ever. You'd set one up through Vanguard or Fidelity, there's a $6000-per-year limit on that. It has one other nice feature -- at any time, you can take your contributions out in an emergency if you have to, without any penalty, as long as you leave the profits you've made in there (and then you can put the money back in if you want, up to the contribution limit for that year).

If you exceed all of those limits for contributions, you can keep going in other ways -- it won't have the tax savings that the other money does, but it's still going to grow in a compound, exponential way. Vanguard or Fidelity are good spots to do that.

Which funds should you pick? My advice is super-low-cost, passively-managed, widely-diversified index funds.

Super-low-cost means that the OER (Operating Expense Ratio) charged by the brokerage is no more than 20 cents, per $100 invested, per year -- or 0.20%.

Passively-managed means that there isn't a human or team of humans who run the fund trying to "beat the market". The problem with that is they (a) need to be paid, by you and the other investors, and (b) they beat the market, on average, about 40% of the time. A chimp could do better and gets paid in bananas.

Widely-diversified means the fund includes lots and lots of stocks and/or bonds so that you're not exposed to one particular company. You don't want to be that guy who puts his entire retirement fund in Enron stock, then loses the whole thing. There's no need for you to gamble; you're going to pile up a *lot* of money playing it safe.

Index funds try to match well-known stock indexes like the S&P 500 or the MSCI International index. The managers of these funds don't try to pick the best stocks; they just try to match these publicly-known indexes as closely as they can. For the most part, they're just buying shares in the appropriate amounts; that's why they can charge so little to their investors.

If you don't want to pick and choose index funds yourself, there's good news -- you can just take your birth-year and add 60 then go to vanguard(dot)com and invest in the Vanguard Target Retirement fund that's closest to the year you calculated (you'll want your fund to be with Vanguard in that event). That fund invests in stock index funds and bond index funds, both US and International, in such a way that will be aggressive when you're young and more conservative as you age, which is exactly what you want to do with a long-term investment -- and it'll happen automatically, without you having to keep track of it.

Some of these investment types, like the 401(k), might be required to be with your employer's broker of choice and you might have a limited number of options for investment funds. That's okay, there's almost always a few funds that are pretty low-cost, passively-managed, diversified index funds. If you want, you can look at the ratios of stock vs. bond, US vs International funds in the Vanguard Target Retirement fund you want and replicate those ratios as closely as you can in your own investments outside of Vanguard. It'll take a little work on your part to keep up with the changing Target fund, but you can actually save a little bit of the OER expense (and you're going to soon have a LOT of money, so it'll be worth it to do so).

Finally, do it automatically. Figure out where you want your money to go and how you want it invested, then have the money taken out of your paycheck before you ever see it. When you get raises and promotions that bump your salary, bump up your investments, too. This is a strategy that will put you on the path to being a multi-millionaire without much chance of failure, to be honest -- if you're 25 years old now, you'd likely be ticking off your third million before you're 50. There are no guarantees in the world, of course, but based on the history of the world economy, you'd be as likely to do *better* as to do worse.

How will you know if you've saved enough to be able to retire?

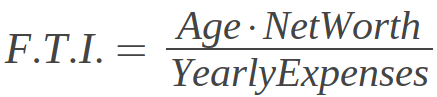

I created a rule of thumb for retirement called the F.T.I., or "F&*% This Index" -- once it's over 1000, you can tell your boss "F&*% This" and retire. :-)

So when I retired at 41 with NW = YE * 35, that meant my FTI was 1435 (actually it was 1450, as I recall).

If you're married, you'd want to average your age with your spouse's age, and you'd want to subtract any known future expenditures from your net worth (most likely example would be college educations for your kids). Yearly expenses shouldn't include taxes or investment spending that you do, either.

So if you are currently 50 and your yearly expenses are $50k, then 50*N.W. / $50k > 1000 when your net worth is just $1,000,000. If you're 30 and your yearly expenses are $60k, then 30*N.W./$60k > 1000 when your net worth is $2,000,000. If you're 40 and your yearly expenses are $120k, then you need $3,000,000.

It's just a rule of thumb; you'd want to pay closer attention to the details when you're actually making the decision whether or not to quit your job. It also assumes that you plan to spend your wealth down to nothing (or close to it) by the time you die; you wouldn't be planning to leave an estate to your heirs.

Good luck to you!

Most pre-retirees focus on getting their investments ready for retirement, but attention should also be paid to getting their home ready while they are still working and making a good income.

To prepare your home for your early retirement, you might:

1. Pay off your mortgage early

2. Downsize your home.

3. Make major repairs. Your priority should be any major repairs you have been putting off as you want to avoid tapping your retirement savings to finance repairs. Major home repairs during the early years of retirement can be very damaging to a long-term investment portfolio.

4. Complete renovations (kitchen, bath, landscaping)

5. Research homes in your dream locale (if you will be relocating)

You should aim to have at least 25 to 30 times your estimated annual expenses saved or invested, though that number may be lower or higher depending on the lifestyle you envision.